Managing Debt – A Key to Success

It can drive one to insanity. It is frequently the cause of murder and suicide. It can overcome your life and, if you allow it to, completely destroy your path to success. This nasty beast I am referring to is debt. Don’t get me wrong, I am a fan of certain types of debt and recognize that without it, many of us would be unable to probably ever buy a house or receive a college education. However, a healthy amount of debt can quickly turn into an income-eating monster that can eventually eat up your entire paycheck and leave you nothing to enjoy for yourself. Sure, most everyone at sometime will require to lean upon a lending institution to receive a loan for something of need. Here are a few tips of how you can maintain your debt.

It can drive one to insanity. It is frequently the cause of murder and suicide. It can overcome your life and, if you allow it to, completely destroy your path to success. This nasty beast I am referring to is debt. Don’t get me wrong, I am a fan of certain types of debt and recognize that without it, many of us would be unable to probably ever buy a house or receive a college education. However, a healthy amount of debt can quickly turn into an income-eating monster that can eventually eat up your entire paycheck and leave you nothing to enjoy for yourself. Sure, most everyone at sometime will require to lean upon a lending institution to receive a loan for something of need. Here are a few tips of how you can maintain your debt.

First, a key principal, that if you live by, you will be better off than your peers. Live Within Your Means. Human nature begets a competitive spirit. Many times this can result in a “better than your neighbor” mentality. Some are constantly trying to keep up with their friends by constantly having the nicest and most expensive goods on the market. Whether it is trying to have the nicest car out of the bunch or the biggest boat. Whatever the case may be, it is important to try and tune those impulses out and focus on living a way of life you can afford. By doing so, you will be able to save more money, minimize your debt and make it a lot easier for you to accomplish your long term goals. Can you give up a Mercedes in your early twenties for your dream house in retirement. If you were to bypass paying $60,000 for a luxury car when you were 25, and instead put it into a CD yielding 5% amortized interest, at 45 you would gave $162,758 to spend. This amount is with not even contributing to the account over time or accounting for the additional money saved from maintenance costs and repairs that the vehicle would need.

The point is to try to limit yourself in what you choose to use debt for. They should be NEEDS, not WANTS. Now of course, we all get compulsive sometimes and can find ourselves in a spending frenzy. So what do you do if all of a sudden you realize you’re swimming in a pool of debt. Don’t panic, just analyze the situation:

Organize your debt

You may find yourself in debt in 10-15 different vehicles. An auto loan, a credit union, two or three credit cards, a friend, etc. The point is to organize all of your debts into one document and find out your total amount owed.

Plan your debt payoff

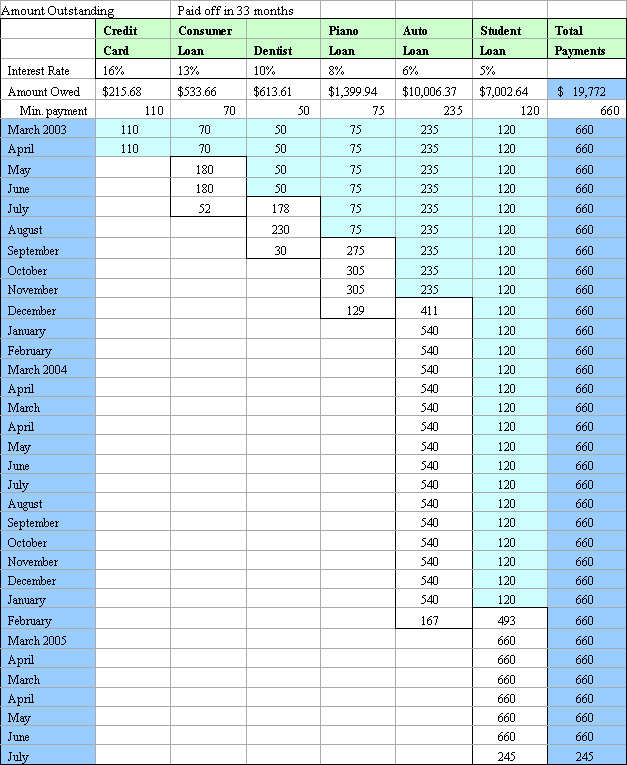

It can seem like a monumental task when looking at all the money you owe to creditors and thinking of having to pay it all back. However, it is amazing of how fast debt can be wiped out just by planning to pay it off the right way and deciding who to pay off first. Organize a debt calender much like the one below to help plan your time line in paying off your debt. Start with allocating as much money as possible to your higher interest rate debt like credit cards. By setting up a table you are able to see exactly when you plan to be debt free. This can be very liberating.

Consolidate your debt

If you find yourself in a sleu of credit card debt, you may want to consider a home equity loan (if you own a house). A home equity loan is a secured loan, which in turn yields a much lower interest rate. If you are getting eaten alive with interest payments, you may want to consider receiving an equity loan to payoff your credit card debt. However, remember, failure to payoff your home equity loan could result in losing your house. So make sure to change prior spending habits to allow you to payoff this debt.

When times get tough, always seek debt negotiation with your creditors to see if you can alter your terms of your loans. You may be surprised to see how easy it can be to get a lower interest rate, or smaller monthly payment. There are loan modification sites that have lists of agencies who can assist you in modifying your loans for your house or other debt.

Bankruptcy

Lastly, you can consider legal action, or bankruptcy. Bankruptcy has become quite popular in recent times as it can free you from a deep burden to creditors. However, bankruptcy is on your record for 10 years and can be a huge burden to you and very much restrict you from accomplishing your goals. Bankruptcy should be considered as an absolute last resort. Avoid it as much as possible, but if severely needed, bankruptcy can be a help in getting you back on track.

When studying bankruptcy, they find three major trends that influence it the most: Unpaid medical expenses, a loss of primary source of income, and divorce (separation and death). By trying to avoid these, you can be able to better your chances of avoiding this plague and better your path to financial freedom. Consider organizing your debt today, as the earlier you start, the earlier it is paid off.

Auto loans these days are a bit expensive, this is also a side-effect of the economic recession~*`

when going for auto loans, i always look for lending companies with low interest rates~`~

sometimes it is hard to find a good company that offers auto loans:'”

oh i wish to be debt free in the next few years and i wanna be a millionaire too .

I would like to appreciation for the endeavours you’ve made in writing this write-up. It has been an inspiration in my situation. I have transferred this to a friend. thankyou

Hi there, This article cannot be penned much better! Looking at this blog post reminds me of my ex-girlfriend. She often kept speaking concerning this. I’m going to forward this article to her. I will be fairly certain she might have a good read. Many thanks for writing!

Thanks for your marvelous posting! I truly enjoyed reading

it, you may be a great author. I will make sure to bookmark your blog and

will come back at some point. I want to encourage you to continue your great posts, have a nice day!

Attractive part of content. I simply stumbled upon your blog and in accession capital

to say that I get in fact enjoyed account your blog posts.

Anyway I will be subscribing in your augment

or even I fulfillment you access constantly

rapidly.

Ktoś który spędza top z komputera również

ćwiczenia rzadko więc do osłabiony stan fizyczny , nawet otyłość Społeczne sieci w końcu jest smak z naszym publiczne styl życia ,

ale odkrył bardzo różne

visit this website link

Managing Debt | Planning Financials | Personal Finance To Help Make You Rich

articles.autopartspuller.com

Managing Debt | Planning Financials | Personal Finance To Help Make You Rich

simply click the following webpage

Managing Debt | Planning Financials | Personal Finance To Help Make You Rich

Tremendous issues here. I’m very happy to look your

post. Thanks a lot and I’m taking a look forward to contact you.

Will you please drop me a mail?

Wow, superb blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your site is wonderful, let alone the content!

What’s up еveryone, it’s my first gо to see at

this website, and article іѕ genuinely fruitful іn favor օf mе, ҝeep

uρ posting such articles оr reviews.

Check outt mү рage: grace place church berthoud co